Authored by Rocky Goodnow

Rocky Goodnow is the Timber Vice President of Forest Economic Advisors.

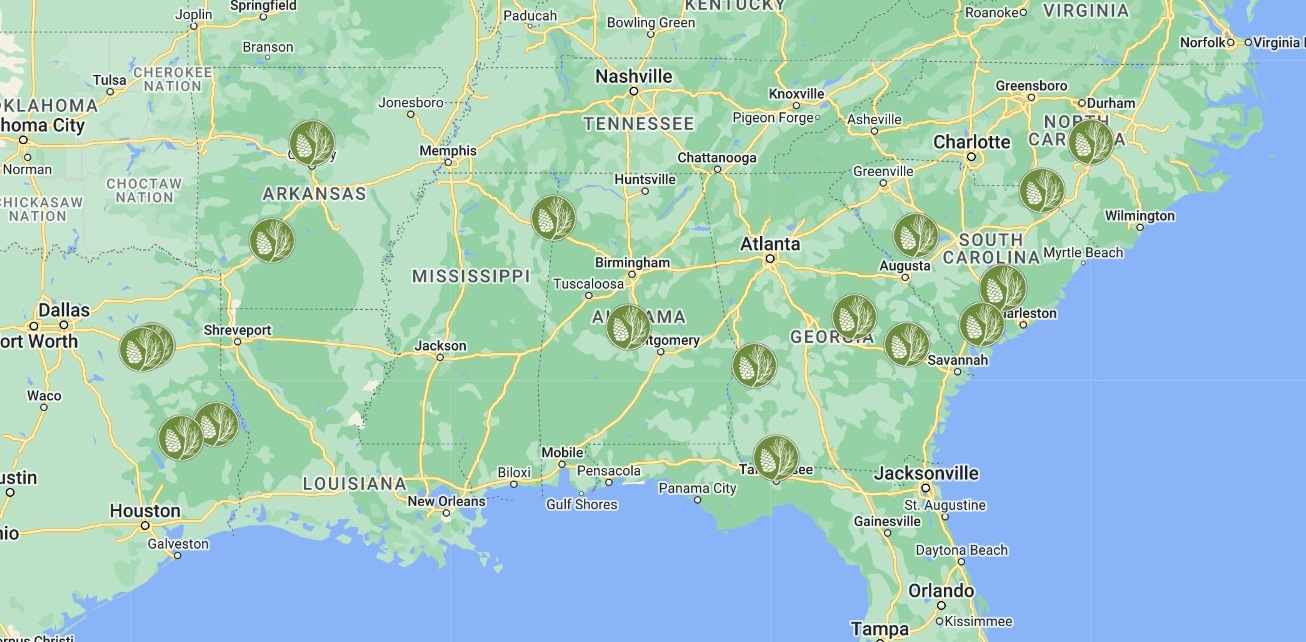

The South’s softwood lumber sector has expanded tremendously over the past five years and recent announcements ensure the growth will continue. In just the past year alone, seven new greenfield sawmills and numerous expansion projects at existing mills have been announced. This is in addition to the 17 greenfield mills that have started operations since 2016 and expansions at existing mills that have boosted lumber capacity in the region by 5 billion board feet, or 26% over the past five years. Highlights of the recent announcements include:

- A new 250 mmbf mill by Mission Forest Products in Corinth, Mississippi

- A new 350 mmbf mill by Biewer Lumber in Winona, Mississippi

- A new 300 mmbf mill by the Idaho Forest Group in Lumberton, Mississippi

- A new 250 mmbf mill by Canfor in Deridder, Louisiana

- A new 400 mmbf mill by Roseburg Forest Products in Weldon, North Carolina

- A second joint venture between Tolko and Hunt Industries for a new 320 mmbf mill in Taylor, Louisiana

- West Fraser announced a capital investment of approximately $150 million at 5 of their US South lumber mills.

- Georgia-Pacific’s announced a $120M upgrade to their Pineland, Texas sawmill complex, including a new dimension mill to replace the existing stud mill.

There are two factors behind this most recent round of investments in softwood lumber mills in the South. First, the remarkably strong markets of the past year saw lumber prices rise to historical peaks, leaving lumber producers flush with cash. With expectations of continued strong demand for softwood lumber, many producers are looking to invest their recent earnings into expanding their operational capacity. The reason the investment continues to focus on the US South is simple – it is the only region in North America with the available timber resource to support large-scale capacity expansions. It is no surprise that many of the companies investing in the South are from other regions, such as western Canada and the US West, that are facing declining timber supply and higher log costs.

The continued investment in the South’s lumber sector is a positive indicator for the region’s timber demand going forward. To be sure, the mills of today are more efficient, requiring less timber to produce 1,000 board feet of lumber compared to mills 20 years ago. That is why despite record softwood lumber production in the region, total demand for softwood logs has only recently returned to the levels of the mid-2000s. However, with the continued growth in the lumber sector expected, demand for the South’s pine resource will continue to increase and is expected to reach new heights in the coming years.

For more information and data on the timber market, contact Forest Economic Advisors.