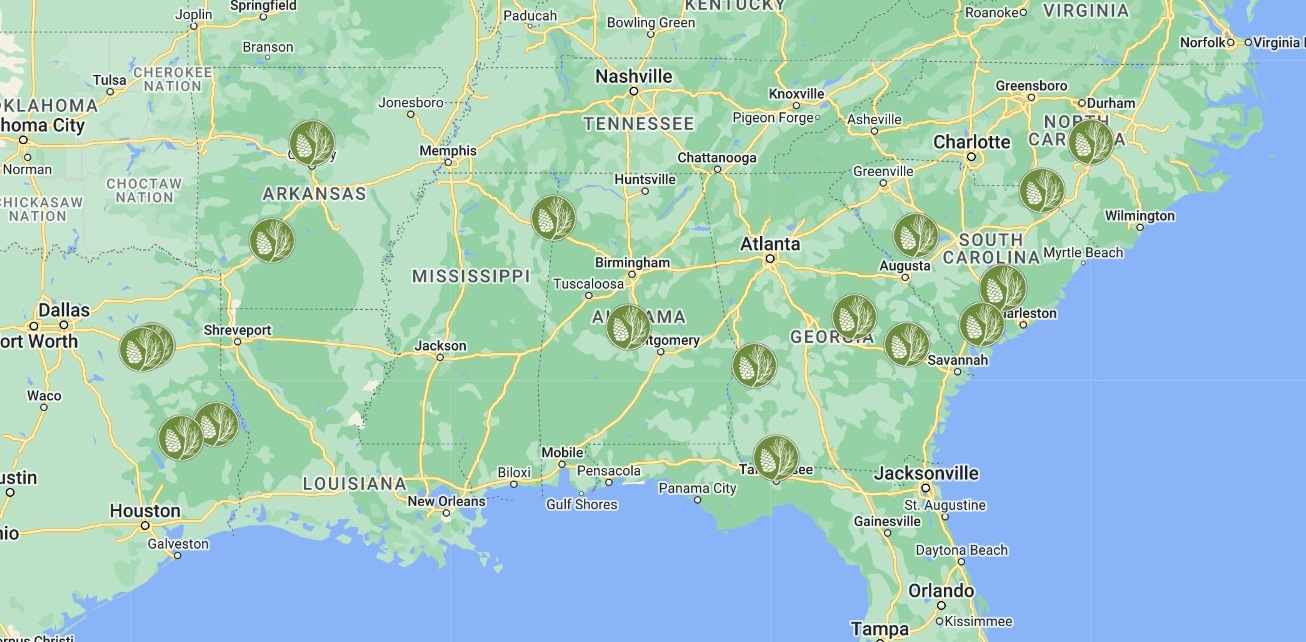

Authored by Forest Carbon Works

Forest Carbon Works is a Chestnut Carbon Company.

In our recent TreeLines article, “Introduction to the Carbon Market and the Opportunity for U.S. Forest Owners,” we explored how forest owners can engage with carbon markets to diversify their revenue streams and contribute to climate change mitigation. Now, we turn our attention to the terminology that underpins these markets. Let’s break down some key concepts to explain the world of carbon offsets and carbon markets.

What are Carbon Offset Credits?

Carbon offset credits measure the reduction of greenhouse gas emissions, primarily carbon dioxide (CO₂). They are quantified in “metric tons of carbon dioxide equivalent,” where one carbon credit represents one ton of CO₂ removed. This standardized metric allows for common comparison of different greenhouse gases, simplifying trading and regulation.

The U.S. Environmental Protection Agency (EPA) defines CO₂ equivalent as the amount of CO₂ emissions that corresponds to the global warming potential of another greenhouse gas. For instance, since methane is 25 times more potent than CO₂, one ton of methane is equivalent to 25 tons of CO₂. This standardization helps regulators, buyers, sellers, and brokers navigate the complex carbon trading landscape.

It’s important to understand the two main types of carbon credits: Removal and Avoidance credits.

Removal Credits: generated through activities that physically remove carbon dioxide (CO₂) from the atmosphere. The primary goal of removal credits is to contribute to net negative emissions, actively reducing the amount of CO₂ in the atmosphere. Examples include:

- Afforestation/Reforestation: Planting trees that absorb CO₂ as they grow.

- Soil Carbon Sequestration: Practices that enhance the amount of carbon stored in soils, such as cover cropping or reduced tillage.

- Carbon Capture and Storage (CCS): Technologies that capture CO₂ emissions from industrial sources and store it underground.

- Improved Forest Management: Generated by practices that enhance the carbon sequestration capacity of forests while promoting biodiversity and ecosystem health.

Avoidance Credits: Generated from activities that prevent the release of CO₂ and other greenhouse gases into the atmosphere. The goal of avoidance credits is to mitigate emissions that would otherwise occur, thereby helping to limit future carbon concentrations in the atmosphere. Examples include:

- Renewable Energy Projects: Generating energy from wind, solar, or hydro, which avoids emissions that would have resulted from fossil fuel-based energy.

- Energy Efficiency Initiatives: Programs that reduce energy consumption in buildings or industries, thereby decreasing the amount of fossil fuels burned.

- Methane Reduction Projects: Initiatives that capture methane emissions from landfills or agricultural practices.

- REDD+ Projects: Generated by implementing practices that avoid carbon emissions from deforestation of existing forests compared to a baseline scenario. These credits are earned by avoiding planned or unplanned deforestation due to land use change in native forest areas.

- Reduction Credits: Generated by implementing new technologies in industrial processes that allow reducing the annual carbon emissions into the atmosphere.

- Replacing oil combustion with electricity or other biodegradable materials.

- Using lower-pollution supply materials in the production chain.

Types of Forest Carbon Projects

To generate carbon offsets, specific forest carbon projects can be implemented. There are three main types of projects eligible for carbon offsets:

- Afforestation or Reforestation: Planting trees in areas where there were none (afforestation) or replanting trees in previously forested areas (reforestation).

- Avoided Land Use Change (REDD+ Projects): Preventing the conversion of forest land to non-forest uses, thereby maintaining its carbon-sequestering capabilities.

- Improved Forest Management (IFM): Enhancing the management of existing forests to increase their carbon storage and sequestration. IFM projects typically involve reducing harvest levels, extending rotation ages, or protecting forests from conversion to non-forest uses.

- Restoration: Recovering the canopy, density, and biomass in forest areas degraded by natural agents such as hurricanes, storms, forest fires and others.

Each project type has distinct costs, benefits, and accounting methods, making it crucial for landowners to understand which best suits their needs. Projects like Forest Carbon Works Conserve that deliver improved forest management (IFM) as part of a nature-based carbon removal program are typically considered higher-quality removals.

Navigating Carbon Marketplaces

There are two primary types of carbon markets: Voluntary and Compliance.

- Voluntary Markets: Voluntary carbon markets allow individuals, companies, or organizations to voluntarily buy and sell carbon credits to offset their greenhouse gas emissions, rather than being required to do so by law or regulation. Many organizations participate to demonstrate their commitment to environmental responsibility and to help meet net zero commitments. Various standards exist to certify projects and credits, such as the Verified Carbon Standard (Verra), Gold Standard, and others and pricing can vary widely based on project type, location, co-benefits, and market demand.

- Compliance Markets: Compliance carbon markets, also known as regulatory markets, are established by laws that cap greenhouse gas emissions, with the California Cap-and-Trade Program as a key example. This structured platform is a system where governments or regulatory bodies mandate certain entities to reduce their greenhouse gas emissions or purchase carbon credits to offset their emissions.

To maintain transparency and accountability, carbon offset projects are documented and tracked through various registries that serve as standards and databases for credits and establish marketplace accountability. Each registry employs unique carbon accounting protocols and methodologies, which can affect a project’s viability and costs. The most widely recognized carbon registries in the U.S. include the American Carbon Registry (ACR), Climate Action Reserve (CAR), and Verified Carbon Standard (VCS). Understanding the specific requirements of each registry is crucial for developers to navigate the market effectively.

Ready to Navigate the Carbon Market?

Whether you’re a landowner considering a forest carbon project, a company looking to purchase offsets, or simply interested in understanding how these markets work, grasping the key concepts can help you make informed decisions.

Our expert team of professional foresters, analysts, and carbon market specialists are available to simplify the process for you. Explore further information and connect with us to discover how you can participate in this growing market!