Authored by Rocky Goodnow

Article by Rocky Goodnow. Rocky is Vice President of the Timber Service at Forest Economic Advisors (FEA), the leading economic consulting firm for the North American forest products and timber industry. In this role, Rocky is responsible for FEA’s outlook on the North American timber markets. Rocky is the primary author of FEA’s Timber Quarterly Forecasting Service publications and is a contributor to other FEA publications and studies. Rocky has spoken at numerous conferences as a recognized expert on North American timber markets.

The US South’s forest product industry is facing a soft-patch but long-term demand growth for timber remains on track.

After two years of remarkable strength in forest product markets, the near-term prospects have dimmed considerably in recent months. Efforts to control the strongest inflation in a generation have led to the highest mortgage rates in 20 years. This along with the rapid increase in home prices during the pandemic has thrown cold water on the previously red-hot residential construction markets, undercutting demand for solid wood products. As a result, softwood lumber prices have retreated sharply from the record levels reached in early 2022 and are at their lowest levels since the beginning of the pandemic.

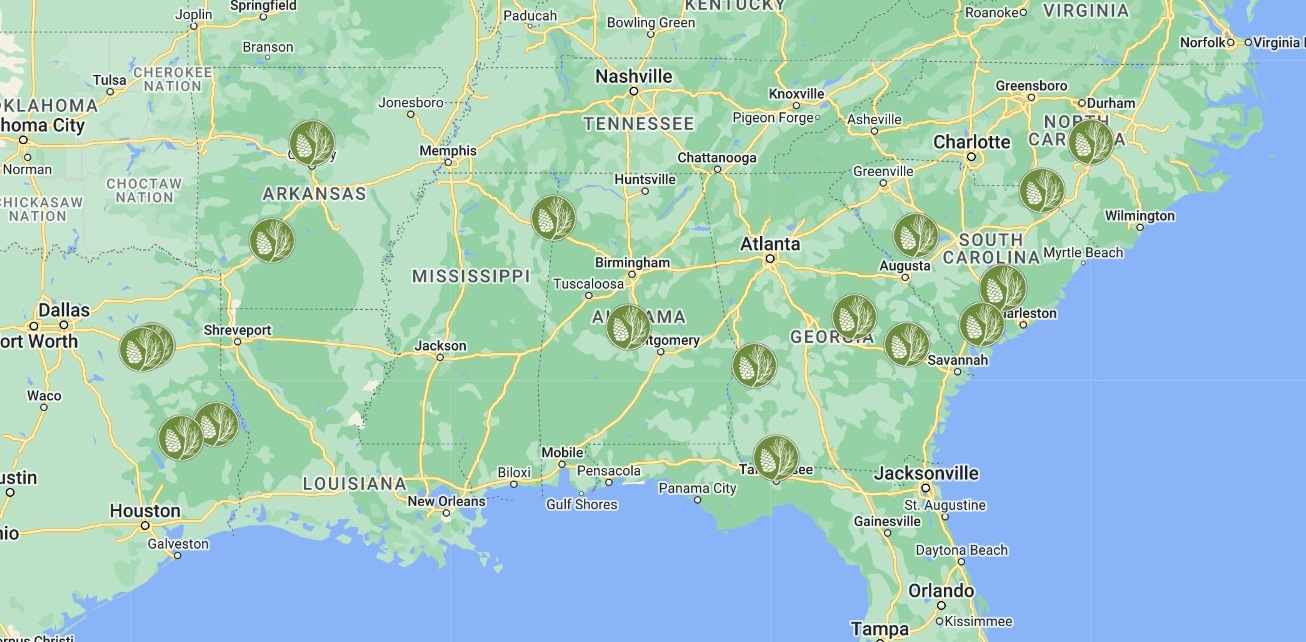

The anticipated downturn in forest product mill production is expected to push demand for sawlogs lower in 2023. A couple of lumber mills have already announced production curtailments and most mills across the region will likely run at lower operating rates. Nevertheless, the decline in log demand will be partially offset by the South’s larger lumber sector. Four new mills began operations and over a dozen existing mills across the South underwent major capacity expansions in 2022.

Past 2023, the prospect for rising sawlog demand remains bright. The downturn in forest product markets is likely to be short-lived given the strong fundamentals underlying US residential construction markets. More than a decade of underbuilding has created tremendous pent-up demand for housing. This along with a large proportion of the adult population entering their prime home-buying years, record home equity, the aging housing stock and historically low inventories of homes for sale all bode well for demand for softwood lumber. And the South’s capacity base will continue to climb. The strong markets of 2021-22 spurred another round of investments in the region’s softwood lumber sector. This includes four new sawmills (below) as well as more expansions at operational mills.

- Teal-Jones’ 300 mmbf sawmill in Bossier Parish, LA

- West Fraser’s complete rebuild of a 275 mmbf sawmill in the Henderson, TX

- Canfor’s 250 mmbf mill in Axis, AL

- CLAW Forestry’s 250 mmbf mill in Gloster, MS

The latest round of expansions in the South’s lumber capacity highlights the region’s status as the low-cost producing region in North America. The abundant supply of Southern Yellow Pine from plantations continues to attract investment from forest product companies. Although the low log costs have limited financial returns to landowners, the continued investment ensures that log demand will continue to rise, ultimately bringing timber markets into balance and injecting support for higher log prices.