Authored by Forest Carbon Works

Forest Carbon Works is a Chestnut Carbon Company.

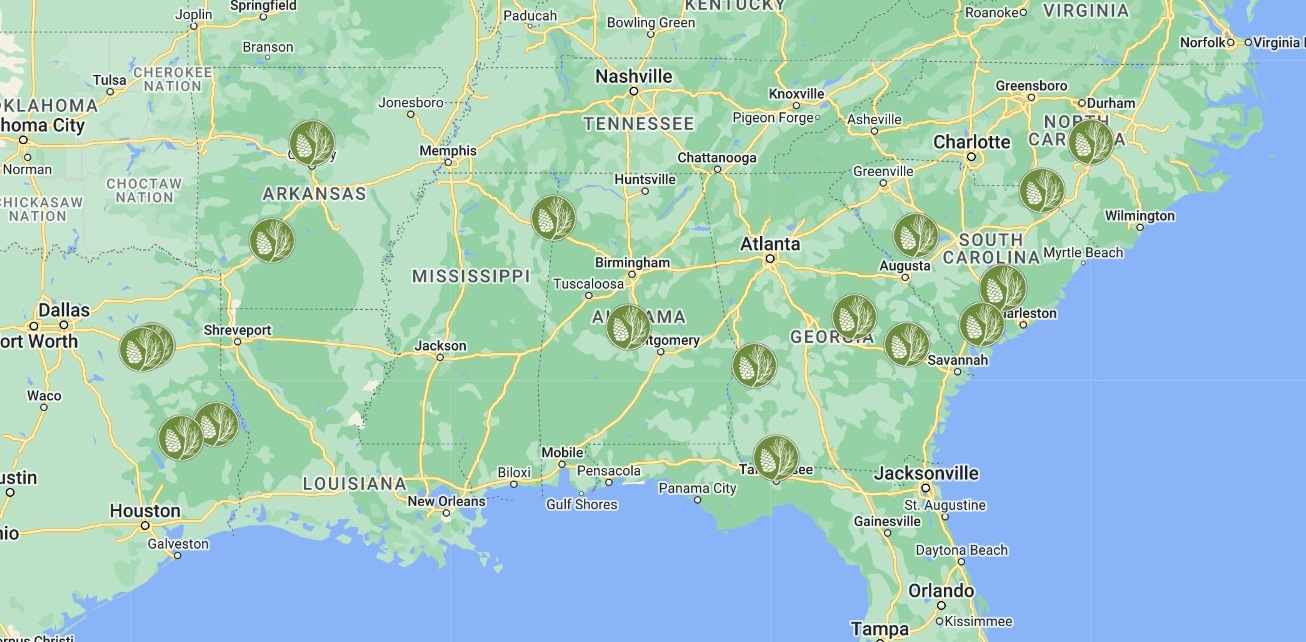

Forest Carbon Works was founded to conserve forests and support private forest landowners in their stewardship efforts. FCW distills the complex processes of the carbon markets into a simple membership service, creating access so that private forest landowners can be recognized and rewarded for long-term conservation.

In the first part of our series, we explored how forest carbon markets offer landowners new revenue streams, helping to offset property taxes and support long-term conservation. Now that you’re considering participating, the next question is: how can you maximize the benefits? Let’s dive into how forest carbon markets can help manage financial pressures—including taxes—and optimize the value of your forest assets.

Understanding the Value of Forest Carbon Credits

Forest carbon markets reward landowners who manage their forests to capture and store carbon dioxide, a key driver of climate change. By participating, landowners can generate carbon credits, which businesses, organizations, and governments purchase to offset their emissions.

Each carbon credit represents one metric ton of CO2 sequestered by your forest. The value of these credits varies based on factors such as market demand, forest type, and carbon storage capacity. The process starts with an assessment of your forest’s carbon stock, followed by ongoing monitoring of carbon sequestration. Once verified by third-party agencies, your carbon credits are registered and ready to be sold.

How Forest Carbon Markets Can Help Offset Taxes

Taxes are a common concern for landowners, but forest carbon markets can provide financial relief in several ways:

- Income from Carbon Credits: Revenue from carbon credits offers a consistent income stream, helping to cover property taxes, federal taxes, and other land-related expenses.

- Tax Deductions for Land Management: Landowners may also qualify for tax deductions related to conservation practices, reforestation, and other environmentally beneficial activities.

- Reduced Property Tax Pressure: The additional income from carbon credits can ease property tax burdens, particularly in regions with high tax rates.

Maximizing Your Revenue Potential: Best Practices for Landowners

To fully capitalize on your forest’s potential and maximize the value of carbon credits, consider these best practices:

- Assess Your Forest’s Carbon Potential: The amount of carbon your land can store depends on the forest type, size, and management. Work with experts like Forest Carbon Works to assess your forest’s carbon storage capacity.

- Plan for the Long Term: Carbon credit projects typically involve long-term commitments. These projects provide both financial and environmental benefits, securing annual revenue and supporting conservation for generations.

- Work with Experts: Navigating the carbon market can be complex. Partnering with experts like Forest Carbon Works will ensure you’re getting the best price for your credits and meeting market standards.

A breathtaking view of forestland enrolled in FCW Conserve.

Photo Credit: storyworkz

The Future of Forest Carbon Markets

As demand for carbon credits grows—driven by corporate sustainability goals and government policies—the value of credits is expected to rise. This offers landowners even greater financial opportunities.

By participating in a forest carbon program, you’re not only supporting climate change mitigation but also positioning your forest as a valuable financial asset that generates income for years to come. The future of the carbon market is promising, and the opportunity to leverage your land’s potential has never been greater.

Are You Ready to Take the Next Step?

If you’re ready to unlock the full potential of forest carbon markets, Forest Carbon Works is here to help. At no cost to you, our team supports landowners at every stage, from assessing your forest’s carbon potential to navigating credit verification and sales.

Learn more at www.forestcarbonworks.org/how-it-works or contact us at 1 (800) 399-5246 or inquire@forestcarbonworks.com. Don’t wait for tax season—take action now to create a sustainable, profitable future through forest carbon markets